Now upload this form 15G in the UAN member portal.īut remember to upload form 15G your PAN number must be linked with your UAN number otherwise UAN portal will not accept the form 15G and you will get the following message that “Verified PAN not available cannot upload form 15G”. Step 2: To upload form 15G in the member portal, first, download form 15G in this post and fill it with blue or black ball pen and scan it and save the document in PDF format, and size should be less than 1 MB. You don’t need to submit form 15G for pension amount withdrawal i.e form 10C amount. Step 1: EPF members who select form 19 i.e PF amount withdrawal in the UAN member portal will get an option to upload form 15G. Here is the step-by-step process of uploading forms 15G and 15H for online PF claims. Now EPF members can upload form 15G and form 15H online at the UAN member portal while applying for the PF claim. Income from fixed deposit interests and post office deposit interests should be less than 50,000 Rs.įorm 15H Filled Sample for PF Withdrawal in 2021 – 22 ( If Age is Above 60 Years)ĭownload Filled PF Form 15H for PF Withdrawal PDF How To Submit Form 15G & 15H Online For PF Withdrawal.

For senior citizens, the annual income should be less than 3 lakhs, and for super senior citizens of age above 80 yrs, the annual income should be less than 5 lakhs.Form 15H will be submitted by the resident individuals whose age is 60 or above 60 along with below income tax slab criteria.Form 15G will be submitted by the resident individuals whose age is below 60 years and their taxable income should be less than 2,50,000 Rs for Fy 2020-21.

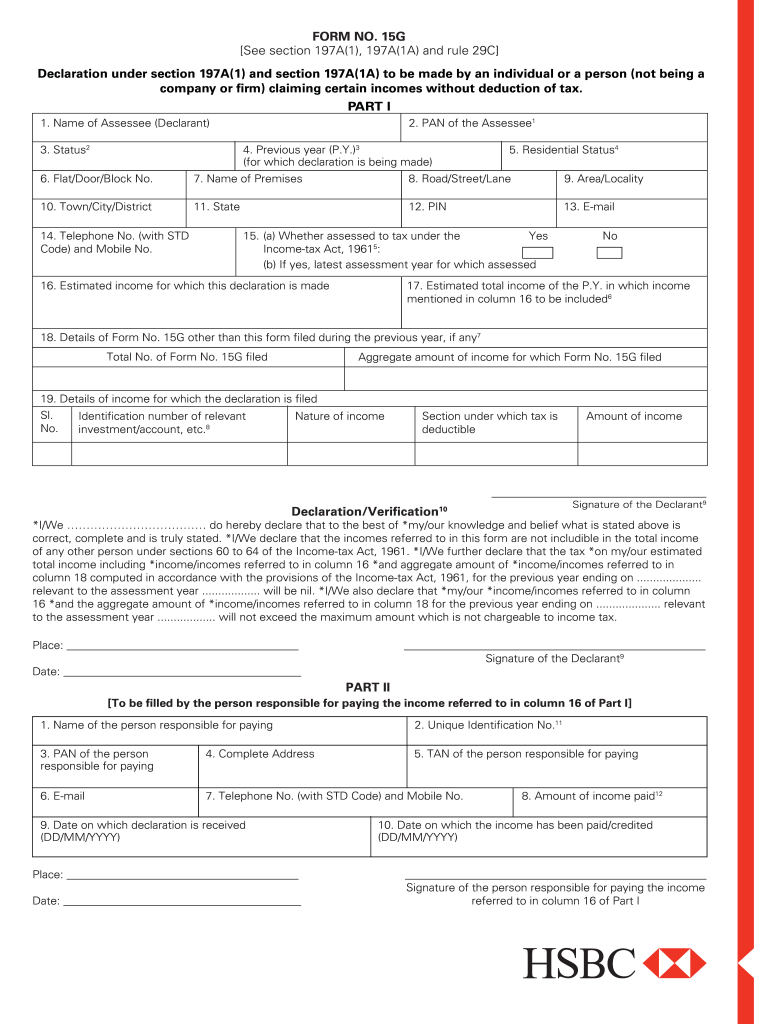

But you have to upload the blank copy of form 15G part 2 while claiming for PF using form 19 at the UAN member portal. The changes will be updated every year here.įorm 15G Part 2: You don’t need to fill part 2 of form 15G, it will be filled by the EPF officers. (Previous year and assessment year change every year, if you are withdrawing PF amount in between 1 April 2021 to 31 March 2022 then mention the above details).

For example, if you mentioned 60000 Rs in field 16 and your annual estimated income is 1,00,000 Rs then mention 1,60,000 Rsįield 18: If any form 15Gs were submitted earlier then mention those details, otherwise leave this field blank.įield 19: Write your UAN, PF number, and the section as 192 (A). (Assessment year is the year followed by the financial for which you paid income tax).įield 16 (Estimated income): PF amount ( employee and employer contribution), not pension amount.įield 17 (Estimated total income): Mention your estimated annual income and PF amount together.

If you tick Yes then mention the assessment year. Field 2 (PAN of the assessee): PAN number of the person withdrawing PF.įields 6 to 14: Address, mobile number, and email id of the person claiming PF.įield 15: If you filed any IT returns then tick Yes, otherwise tick No.

0 kommentar(er)

0 kommentar(er)